New State-By-State Analysis of GOP Tax Hike Plan: Crushing Tax Increases for Families Across America

From the Speaker's Press Office:

This week, the nonpartisan Institute on Taxation and Economic Policy (ITEP) released a new state-by-state analysis of the Republican tax proposal to raise taxes on – in GOP Senator Rick Scott's own words – "over half of Americans." And while Democrats cut taxes for working families in the American Rescue Plan signed into law one year ago this week, this new analysis found that the GOP plan "would increase taxes by more than $1,000 on average for the poorest 40 percent of Americans."

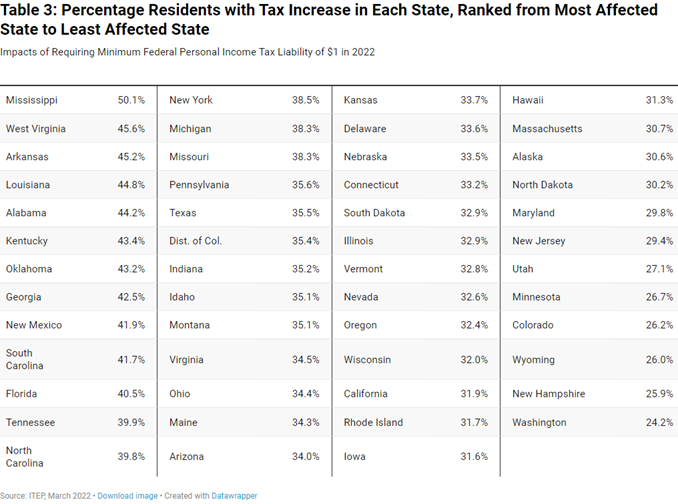

In every state across the country the hardest working families would shoulder huge tax increases – but more than 40 percent of taxpayers living and working in Mississippi, West Virginia, Arkansas, Louisiana, Alabama, Kentucky, Oklahoma, Georgia, New Mexico, South Carolina and Florida would see their tax bills skyrocket.

While Republicans plan to squeeze America's hardest-working families with higher tax hikes and try to rip away their health care, Democrats are still hard at work to pass legislation to further lower everyday prices, fight inflation and cut taxes for middle-class families, paid for by finally making giant corporations and the wealthiest pay their fair share.

See below for more key points from the nonpartisan group's state-by-state analysis here:

Institute on Taxation and Economic Policy: State-by-State Estimates of Sen. Rick Scott's "Skin in the Game" Proposal

- A recent suggestion from Sen. Rick Scott, the chairman of the National Republican Senatorial Committee (NRSC), to require all Americans to pay federal personal income taxes would increase taxes by more than $1,000 on average for the poorest 40 percent of Americans.

- The states most affected, where more than 40 percent of residents would face tax increases, are located mostly in the south: Mississippi, West Virginia, Arkansas, Louisiana, Alabama, Kentucky, Oklahoma, Georgia, New Mexico, South Carolina and Sen. Scott's home state of Florida.

- The only possible interpretation of Sen. Scott's proposal is that everyone who has negative federal income tax liability under current law would instead have federal income tax liability of at least $1. The EITC and Child Tax Credit would no longer provide households with negative income tax liability, meaning no one would receive money from the IRS after they file their tax return. The most significant effects would be felt by the poorest 40 percent of Americans…

- [T]he poorest fifth of Americans would pay 34 percent of the total tax increase under the proposal, and the average tax hike for this group would be around $1,000. This would happen because the average federal personal income tax liability for this group under current law will be around negative $1,000 due to the EITC and the Child Tax Credit. (This figure varies depending on the number of children and the amount of earnings a household has.)

- [T]he only possible interpretation of Sen. Scott's proposal is that it would wipe out significant benefits that low- and moderate-income Americans currently receive from these tax credits.